This article discusses what and all to know about cryptocurrency before investing.

Cryptocurrency or Crypto is a digital money or currency system and a peer-to-peer program that permits transactions through computer networks and maintains records on a decentralized system.

In contrast to the centralized authority that controls the physical or real-world currency exchange.

The use of cryptography in transaction processes, i.e., advanced coding in storing and transmitting, gave birth to cryptocurrency. Cryptography provides more security, safety, and confidentiality.

The first known cryptocurrency is Bitcoin, brought to the limelight in 2009 by a mysterious person named Satoshi Nakamoto.

Bitcoin is the most significant cryptocurrency value and most popular among crypto users.

How Does Cryptocurrency Work?

Cryptocurrencies operate on a distributed public book or ledger called a blockchain. Investors keep track of transactions on this public ledger.

Cryptocurrency involves mining—a competitive process that validates and adds new transactions—currencies (coins), to the blockchain, i.e., by solving complex mathematical problems on a computer network.

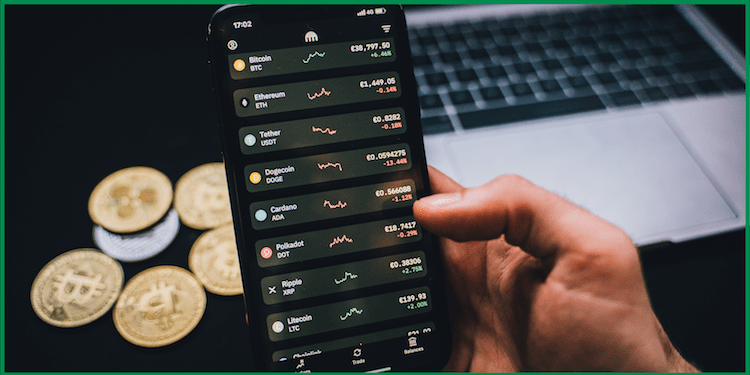

Examples of Cryptocurrency

There are thousands of cryptocurrencies. The following are a few of the most well-known cryptos:

Bitcoin:

Bitcoin was developed in 2008 and introduced in 2009. The first Crypto and the most traded cryptocurrency.

Ethereum:

Developed in 2015, Ethereum is a blockchain platform. Ether (ETH) or Ethereum is the company’s native coinage. The next most popular Crypto after Bitcoin.

Litecoin:

This currency acts similarly to Bitcoin but is lighter in the process than Bitcoin.

Crypto Investment: Pause! Have you considered these?

Investing in cryptocurrencies is highly speculative and highly risky.

Celebrities and influencers may have claimed that investors make millions and become wealthy daily in Crypto.

It is not always greener on the other side. Others have fallen into investment scams, and some individuals are ill-informed about investment options.

The opportunity to get rich through Crypto investment might be tempting; however, it is essential to understand the features of cryptocurrency.

First and foremost, this market is highly volatile. Currencies that rose rapidly in value can also drop to zero unannounced.

Furthermore, unlike other markets, the future of cryptocurrency regulation is uncertain.

Countries that allow free or minimal use of Bitcoin include the U.S., Canada, and Australia, to name a few.

El Salvador accepted Bitcoin as a legal tender.

However, some countries, such as South Korea, are pushing for a Crypto restriction law, while countries like China want to ban cryptocurrency.

The United States has followed suit to tax crypto investment.

Advocates for Crypto acceptance have grown more prominent; however, the adoption may take some time because other financial regulators worldwide criticize the inability to control and regulate the currency system.

Calculating a cryptocurrency’s real value may be more complex than publicly-traded company stock options.

Stock options represent a product or service, while general public acceptance decides the crypto value.

Safety Measure: Tips For Investing In Cryptocurrency

According to Consumer Reports, all investments are risky. But some experts consider cryptocurrency more complex than other traded options, such as Stocks, Bonds, ETFs, etc.

If you’re considering a crypto investment, note these:

Research and Review:

Before investing, learn about such Crypto you would put in your money.

Learn about the coin’s worthiness and its use. There are over hundreds, if not thousands, of Crypto-coins out there.

There is a phrase called Pump and Dump! Do research, and read reviews.

Safety and Security:

Buying cryptocurrency is good, But keeping it safe is essential.

There are different ways of storing cryptos. Consider your option wisely.

Diversify Investment Portfolio:

Don’t put all eggs in a basket.

Try splitting investments into different portfolios to avoid a more significant loss of funds. E.g., Putting 100% of investment funds in Bitcoin seems perfect.

Still, the ROI (Return On Investment) in Bitcoin may be insignificant compared to someone diversifying their investment.

Moreso, It isn’t safe due to the loss of value of such a coin.

An investor may lose all if only one portfolio or currency holds the totality of the investment.

Long-Term Projection:

Due to crypto volatility, long-term investment is encouraged.

Crypto has mixed feelings among investors. Some believe it’s a get-rich-quick plan, while some believe it is a store of value (generational wealth).

For your well-being, it is encouraged to project success in crypto investment for extended periods.

Do you enjoy this reading? Kindly share with family, friends, and colleagues. Thanks 🙂